Between tracking billable hours, handling client funds, and staying compliant with regulations, it’s a lot to handle. You didn’t go to law school to become an accountant. That’s where specialized accounting software for law firms becomes not just a nice-to-have, but absolutely essential.

Many law firms quickly discover that general accounting software falls short. These off-the-shelf solutions often lack the specific features and functionalities needed to manage the intricacies of the legal world. Trust accounting isn’t your everyday bookkeeping task, and managing IOLTA accounts requires specialized knowledge.

In this article, we’ll look at what makes law firm finances unique and how to choose the best law firm accounting software for your needs.

Understanding Law Firm Accounting Needs

You might be asking, “What’s the big difference between general accounting and legal accounting?” It’s a valid question, and the answer highlights why specialized software is so critical. General accounting software is designed for a broad range of businesses across various industries. While it might competently handle your basic income and expenses, it often misses the mark on the critical features that law firms absolutely need to function effectively. Accounting software for law firms, on the other hand, is built from the ground up with those specific needs in mind.

What are those “must-have” features? Let’s dive into the essentials:

- Trust Accounting: This is absolutely non-negotiable. As a law firm, you’re entrusted with handling client funds, and those funds need to be kept strictly separate from your firm’s operating funds. Legal accounting software makes this segregation easy and automatic, helping you maintain compliance and avoid potentially serious ethical violations.

- Time and Billing: Billable hours are the lifeblood of most law firms. You need a strong and reliable system to accurately track time, generate detailed invoices, and efficiently manage client billing. This isn’t just about making sure you get paid for your work. It’s about maintaining fair and transparent billing practices that build trust with your clients.

- Compliance: Law firms operate under a strict and complex set of rules and regulations. Your accounting practices must adhere to these regulations, which can vary significantly by jurisdiction. Specialized software helps you stay on the right side of the law, especially when it comes to things like IOLTA accounts and strict IRS guidelines. It helps you avoid costly penalties and maintain your professional standing.

You might be thinking, “This sounds incredibly complex and time-consuming!” And you’re right; it can be. Accounting firms which specialize in legal accounting can take the burden entirely off your shoulders, expertly managing these intricate tasks efficiently, accurately, and with complete peace of mind. Instead of struggling with spreadsheets and worrying about compliance, you can focus on what you do best: practicing law.

Leading Accounting Solutions

Let’s look at some of the top software options currently available. It’s important to find the right fit for your firm, so let’s break down some of the most popular choices:

1. QuickBooks: You’ve almost certainly heard of QuickBooks Online (QBO). It’s a widely used and well-known general accounting software solution that is popular among small businesses. While it offers some features that can be adapted for legal accounting, it often requires additional workarounds, integrations, or third-party add-ons to fully meet the unique needs of a law firm.

- Key Features:

- Customizable invoicing

- Comprehensive expense tracking

- Powerful financial reporting

- Integration with some legal software applications

2. Clio: Clio is primarily recognized as a comprehensive practice management software solution, but it also includes strong and tightly integrated accounting features. This makes it a potentially excellent option for firms looking for an all-in-one solution to manage not only their cases and client relationships but also their finances in a seamless and integrated manner.

- Key Features:

- Integrated billing and trust accounting

- Comprehensive time tracking capabilities

- Strong client management tools

3. LeanLaw: LeanLaw is specifically and exclusively designed for legal billing and accounting and offers seamless integration with QuickBooks. This provides a powerful combination for law firms that desire the accounting capabilities of QuickBooks but also need legal-specific billing features that are purpose-built for their unique needs.

- Key Features:

- Deep and seamless QuickBooks integration

- Comprehensive trust accounting compliance features

- Streamlined time tracking and invoicing processes

4. Xero: Similar to QuickBooks, Xero is a highly versatile cloud-based accounting software solution that offers flexibility and a wide range of integrations. This can be particularly useful for law firms that need to connect their accounting software with other essential tools. However, like QuickBooks, it may also require some degree of customization to fully and effectively handle the specific requirements of legal accounting.

- Key Features:

- Automated bank reconciliation processes

- Highly customizable invoicing options

- Convenient multi-user access

5. CosmoLex: CosmoLex is a comprehensive cloud-based accounting software solution designed specifically and exclusively for law firms. It offers tightly integrated business and trust accounting, financial reports broken down by client and matter, and a straightforward approach to law practice management.

- Key Features:

- Fully integrated business and trust accounting

- Detailed financial reports by client and matter

- Streamlined law practice management tools

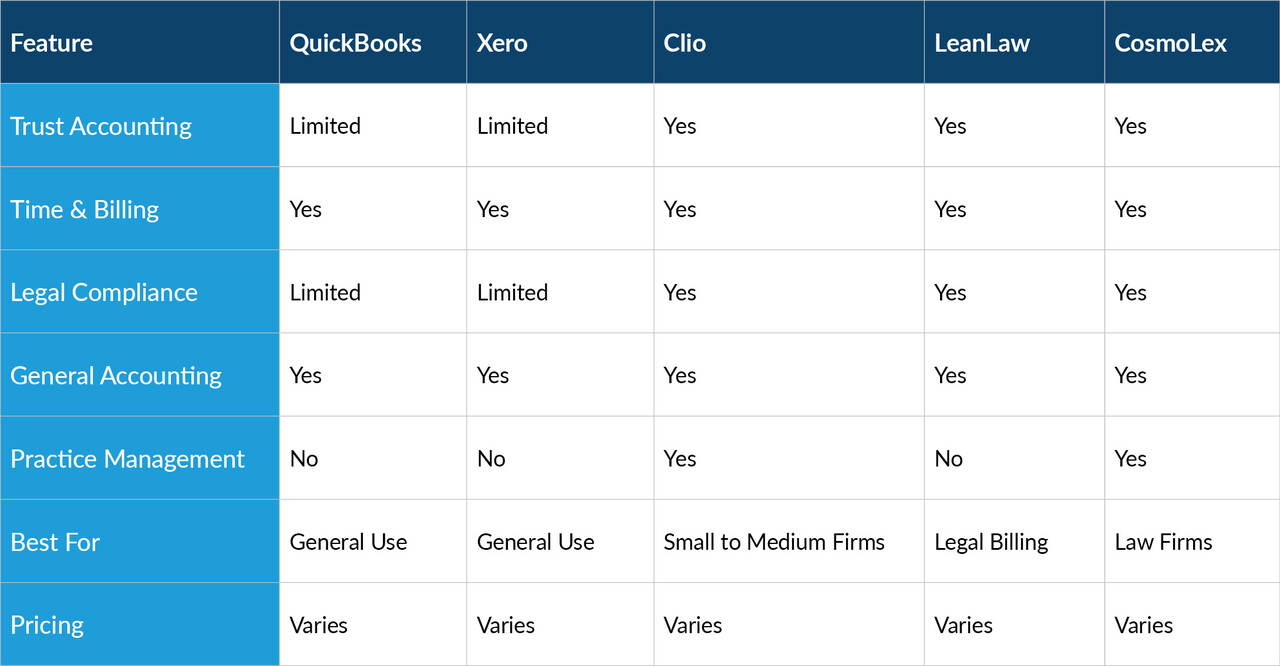

To give you a clearer picture, here’s a comprehensive comparison table outlining the key features and capabilities of each software solution:

Affordable Accounting Options

Small law firms often operate with tighter budgets and limited resources, so choosing the right accounting solution is especially critical. You need solutions that are not only cost-effective and easy to use but also scalable to accommodate your firm’s future growth. It’s a delicate balancing act! Fortunately, several software options are particularly well-suited for the unique needs of small firms. When evaluating your options, look for those that offer:

- Ease of Use: You don’t have the time or resources to invest in learning a complicated system. Choose software with an intuitive and user-friendly interface that you and your staff can easily manage with minimal training.

- Affordability: Start-up costs and ongoing monthly fees can quickly add up and strain your budget. Look for solutions that offer flexible pricing plans or specific packages tailored to the needs of small businesses.

- Scalability: Even if you’re small now, you likely have ambitious plans for the future. Look for software that can grow seamlessly with your firm, adding new features and increasing capacity as your firm expands its operations.

To give you a concrete idea of how this works in practice, imagine a small law firm specializing in family law matters. They initially started with very basic accounting software but quickly realized it couldn’t adequately handle the complexities of trust accounting, a critical aspect of their practice. They made the strategic decision to switch to Clio, which not only efficiently managed their finances but also helped them better organize their cases and streamline client communications. This significantly improved their overall efficiency and freed them up to focus on what truly mattered: providing exceptional legal services to their clients.

Time-Saving Automations

Let’s talk about making your life as a legal professional significantly easier. Integration and automation are absolutely key to streamlining your law firm’s operations and maximizing your efficiency. The more tasks you can automate, the less time you’ll spend on manual administrative work, and the more time you’ll have available for billable client work.

Integrating your law firm accounting software with other essential legal tools, such as practice management systems and customer relationship management (CRM) platforms, can create a seamless and highly efficient flow of information throughout your firm. For example, when you thoroughly record billable hours within your practice management system, that data can automatically flow into your accounting software for invoicing, eliminating the need for redundant data entry and significantly reducing the risk of errors.

Automation features within accounting software for law firms can also be a complete game-changer. Imagine the possibilities:

- Automated Invoicing: No more manually creating and sending out invoices to clients. The software can automatically generate and send invoices according to your predefined billing schedules, saving you countless hours each month.

- Automated Payment Tracking: The system automatically and accurately records payments received from clients, eliminating the tedious task of manual data entry and reconciliation.

- Automated Compliance Checks: Some advanced software solutions can even help you maintain continuous compliance with relevant regulations by proactively flagging potential issues or automatically generating detailed reports for your review.

Security and Compliance Considerations

When it comes to legal accounting, security and compliance aren’t simply important; they’re absolutely essential for protecting your firm’s reputation, maintaining client trust, and avoiding potentially severe penalties. As a law firm, you’re entrusted with handling highly sensitive client data and confidential financial information. Any breach or security lapse can have devastating consequences, both financially and in terms of damage to your professional reputation.

Here are some critical security considerations that you must carefully evaluate when choosing accounting software for law firms:

- Powerful Data Encryption: Your law firm accounting software must use industry-standard encryption protocols to protect your valuable data, both while it’s being transmitted over the internet and while it’s stored on the software provider’s servers.

- Granular Access Controls: As a business owner, you need to be able to fine-tune who can see your company’s financial information and what amount of access they have. Look for software that lets you set very specific permissions so that you can limit access based on jobs and responsibilities.

- Compliance with Data Protection Regulations: You must make sure that your chosen software and your accounting practices fully comply with all applicable data protection regulations, such as those governing how you collect, store, and use client information. Failure to comply can result in significant legal and financial repercussions.

Compliance with all relevant legal regulations is equally critical. Accounting software for law firms must be designed to help you adhere to all standards related to:

- Maintaining Separate Client Funds: As we’ve emphasized throughout this guide, this is a fundamental requirement for all law firms. Your accounting software must provide robust features for managing and segregating client trust funds.

- Anti-Money Laundering (AML) Regulations: You may also be required to comply with complex AML regulations designed to prevent money laundering and other financial crimes. Your software should assist you in meeting these obligations.

Finding Your Perfect Match

How do you choose the right accounting software for your law firm from the many options available? Here’s a practical step-by-step guide to help you assess your needs and select the solution that best fits your specific requirements:

- Assess Your Firm’s Size and Complexity:

- How many employees do you currently have?

- How many active clients do you typically serve?

- What is the overall volume of financial transactions your firm handles each month?

- Establish a Realistic Budget:

- What is your firm’s budget for accounting software, including both initial setup costs and ongoing monthly or annual fees?

- Identify Must-Have Features:

- What are the absolute must-have features for your firm? (e.g., robust trust accounting, integrated time and billing, seamless practice management integration, automated compliance checks)

- Evaluate Scalability:

- Will the software be able to easily scale with your firm as you grow and expand your operations?

- Prioritize Ease of Use:

- How easy is the software to learn, implement, and use on a daily basis? Look for an intuitive interface and comprehensive training resources.

- Scrutinize Security Measures:

- Does the software meet your firm’s stringent security requirements, including data encryption, access controls, and compliance with relevant regulations?

- Confirm Compliance Capabilities:

- Does the software provide built-in features and tools to help you comply with all applicable legal and ethical regulations, including those related to trust accounting and anti-money laundering?

Beyond Software

While choosing the right accounting software for law firms is essential, many firms find that outsourcing their accounting functions provides additional benefits. Outsourced legal accounting services offer an alternative to managing everything in-house.

Benefits of this approach include:

- Access to specialized expertise in legal accounting standards and compliance

- Reduction in overhead costs compared to maintaining in-house staff

- Consistent coverage without concerns about staff turnover or absences

- Implementation of industry best practices from day one

- Regular updates on regulatory changes affecting your practice

Cashroom specializes in providing outsourced legal accounting services tailored to law firms. With system-agnostic capabilities, we work with whatever accounting software your firm prefers, offering services including:

- Trust accounting and compliance management

- Financial statement preparation

- Accounts payable and receivable processing

- Secure portal access for document sharing and approvals

For firms looking to focus more on legal practice and less on financial administration, outsourcing can be a viable solution to consider alongside your software selection.

Our specialized expertise and innovative solutions are carefully designed to help you maintain a competitive edge, stay compliant with complex regulations, and maximize your firm’s profitability. We see ourselves as more than just a service provider; we aim to be your trusted ally in managing your firm’s finances, so you can focus on what truly matters: providing exceptional legal services to your clients. Contact us today to learn more about how Cashroom can help your firm thrive in the years to come.

FAQs

Can I use general accounting software like QuickBooks for my law firm?

Yes, but it requires careful setup to handle trust accounting and other legal-specific requirements. Many firms enhance QuickBooks with legal-specific add-ons or outsourced expertise to ensure compliance.

How much should I budget for law firm accounting software?

Expect to invest $30-100 per user per month for quality legal accounting software. While this might seem significant, the efficiency gains and compliance protection typically deliver strong return on investment.

Is cloud-based accounting software secure enough for law firm data?

Leading cloud providers often offer security that exceeds what most small firms could implement on-premises. Look for vendors with strong encryption, regular security audits, and compliance certifications.

Should my accounting software integrate with my practice management system?

Integration dramatically improves efficiency by eliminating duplicate data entry and providing comprehensive matter-based financial reporting. This integration has become a standard feature in modern legal technology stacks.

What's the biggest mistake law firms make with accounting software?

The most common error is selecting software without proper consideration of trust accounting requirements. This can lead to compliance issues, inefficient workflows, and potentially serious ethical violations.

How can I improve cash flow through my accounting software?

Implement features like automated invoicing, online payment options, scheduled payment reminders, and detailed accounts receivable tracking. Check out our guide on 10 Simple Ways To Manage Your Law Firm’s Cash Flow for more detailed strategies.